The world is always changing and so are the legal risks to your business. A few of my clients provide services to other businesses and in providing services intellectual property is created and they have access to their client’s systems. These two pose a risk if you have not thought through the implications of a changing world and a need to account for those changes in your contracts.

Here are 3 contract clauses I have started adding to my client’s contracts:

Data Security & Cybersecurity

If you have access to a client’s systems or data or vice versa, then there’s always a risk of a cyberattack or virus infecting your systems. I worked a case once where a hacker lied dormant in a third party’s system for months. They got access through an employee and then got access to a larger company because their systems were connected. The hacker shut down the larger company’s system until a ransom was paid and they had to keep operations going from their personal email account.

As a small business, could you afford to have your website shut down, your business accounts blocked, or your emails and social media pages hacked? Think about how interconnected technology is that you need a code sent to your telephone or email to access your accounts for security purposes yet if there is a security breach you may have just given the hacker access to another account.

To prevent that, I’ve started adding safety language to protect my clients and require certain data security measures be taken and detail cybersecurity protocols and notifications if a clients system is hacked. Don’t forget notice. I’ve been adding a deadline for when they must notify my company if their systems become comprised.

Ban on AI for Intellectual Property

Whether you know it or not, anything created by AI is not copyright protected. Most folks are not reading the terms of service, and companies like Zoom, have new terms added to use your content and data to train their AI machines.

In business, you may share proprietary and confidential information like trade secrets or intellectual property. That could be at risk if inputted into AI software or software that you grant the use of your data by using to train their AI software. Don’t lose what gives you your competitive edge by having no restrictions on what clients can and cannot do with the information you share. No one knows how secure these machines and software are from a cyberattack that can leak info.

If content is created by AI, anyone can use and there is no protection. If content is imputed into AI systems, it can be leaked. Trade secrets are only protected if they remain a secret.

That’s why I’ve been adding contract language to address the use of AI and make sure my clients secure their intellectual property.

Social Proof Use

I already add this very important IP clause but I’ll share it here because I think it may helpful to you.

Marketing and Advertising Permission:

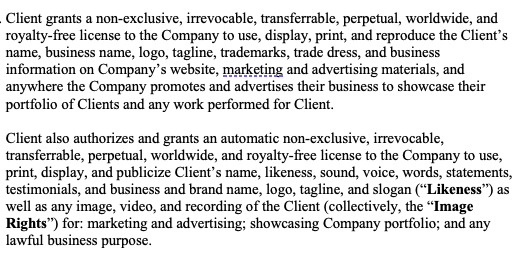

In copyright law, the creator owns the copyrights, even to their logo. It is copyright infringement to use it without their permission.

Individuals have the right to profit from their name and likeness, which means they control who can and cannot use their name, face, image, words, and voice.

But when you do work for clients, you want to use their testimonial right. Put their logo on your website as proof you got the skills for prospective clients and customers to see who you worked with or what media publications you’ve been published in.

Most don’t realize that without the right to do so, they can be sued for copyright infringement and more.

For my clients, I write the permission into their contracts and even grant the other party some permissions as well with control given to my client because ain’t nobody got time for someone to twist your words or use your branded logo that represents the brand you’ve been building to promote anything illegal or tore up from the floor up.

Okay… enough said there.

Here’s a sample clause I use and it’s just a sample that has to be customized for each unique scenario and business - it’s also not legal advice and you use it at your own risk (I’m not your attorney, unless I actually am which just bring your contract to me, and I’m not responsible for you using this clause).

Here’s the sample clause:

This is a sample and not to be copied and pasted. This does not reflect all the contract provisions in this section.

Do your contracts cover these areas?

If not and you’re a Maryland or DC business owner or nonprofit, my law firm, Legacy Legal & Consulting Firm, can help you tighten up your contracts and make sure your protected as the virtual landscape changes.

Schedule a discovery call today at www.legacylegalconsult.com.